Which of the Following Best Describes a Fiscal Policy Tool

Financial capital markets D. Option B is incorrect.

Solved 1 Which Of The Following Best Describes A Fiscal Chegg Com

Previous question Next question.

. When nations desire a healthy macroeconomy they typically focus on three goals. Fiscal policies are the government tools used by the government to influence the aggregate demand in the economy. Question 9 1 1 point In the circular flow.

Question 2 Which of the following best describes fiscal policy. Government spending is one of the fiscal policy tools. Up to 256 cash back Which of the following best describes a fiscal policy tool.

Up to 256 cash back Get the detailed answer. Indirect taxes can be modified quickly. The fiscal policies are of two types expansionary and contractionary policy.

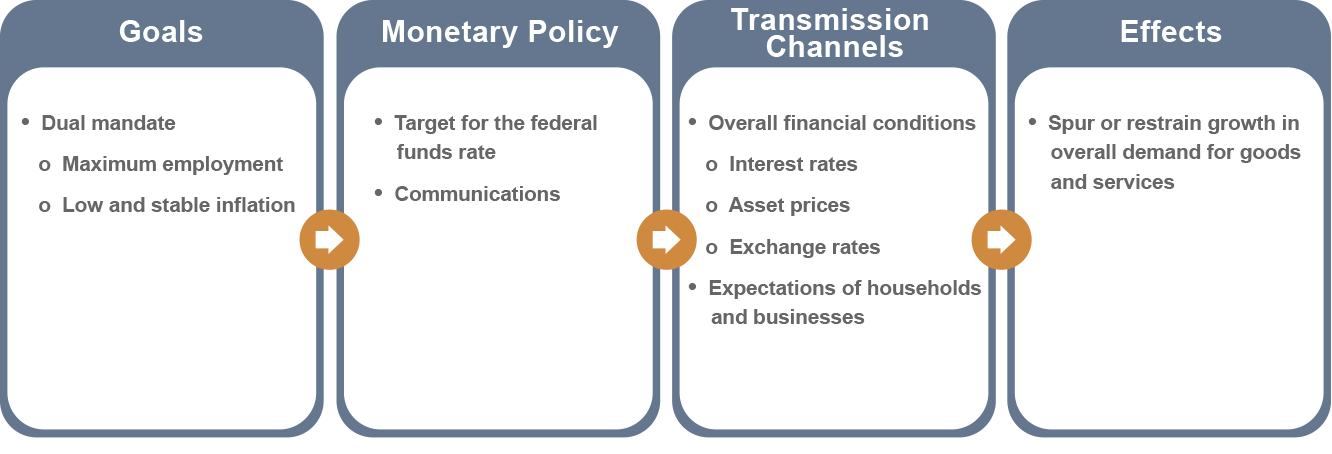

The central bank has the ability to stabilize the economic fluctuations by altering the money supply and the interest rates in the economy. In case of contractionary fiscal policy the government spending decrease. View full document.

Fiscal policy is concerned with _____. Which of the following best describes a fiscal policy tool. Describe tools of fiscal policy including their advantages and.

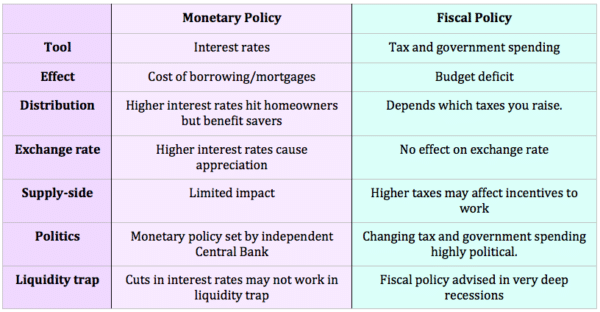

It is the other half of monetary policy Monetary Policy Monetary policy refers to the. The two main tools of macroeconomic policy include monetary policy and fiscal policy which involves _____ spending. Indirect taxes have a greater effect on alcohol consumption as compared to direct taxes.

Changes in government purchases. A household spending b bank lending c financial capital markets d government spending. The Fed changing interest rates to reach full-employment equilibrium.

Which of the following best describes a fiscal policy tool. Up to 256 cash back Get the detailed answer. Option A is incorrect.

Which of the following best describes a fiscal policy tool. Which of the following best describes a fiscal policy tool. Fiscal policies are the government tools used by the government to influence the aggregate demand in the economy.

Such policies are framed concerning their impact on the country ie on consumers organizations investors foreign markets etc. Discretionary fiscal policy _____. Which of the following best describes a fiscal policy tool.

The Fed changing taxes and government expenditures to reach full-employment equilibrium. Government spending and changes in the money supply. One of them being.

Question 1 1 1 point In the _____ households work and receive payment from firms. Aggregate demand is the total quantity of demand for all products and services produced by the economy. The Fed changing taxes and government expenditures to reach full-employment equilibrium.

In case of expansionary fiscal policy the government spending increase. Financial capital markets D. Fiscal policy used to close an expansionary gap is known as _____.

What are the tools of fiscal policy. The fiscal policies are of two types expansionary and contractionary policy. The federal reserve provides lending directly to consumers businesses and other banks B the federal reserve directs monetary policy sets interest rates and provides banking.

The government uses these policies to influence demand and inflation in the economy. 100 3 ratings The answer is GOVERNMENT SPE. The government uses these policies to influence demand and inflation in the economy.

Which of the following best describes a fiscal policy tool. I tax rate ii government spending iii reserve requirements iv all of the above. A savings market b financial capital market c financial investment market d labor market Question 2 1 1.

It has various monetary policy tools which includes the use of open market operations the use of federal funds rate discount rate and the required reserve ratio for the banks. Which statement best describes the roles of the Federal Reserve. A federal budget deficit occurs when _____.

View the full answer. Federal government purchases exceed net taxes. Money supply and taxation.

Changes in government purchases andor taxes designed to achieve full employment and low inflation. 1 The answer is option A. Is the deliberate manipulation of government purchases transfer payments and taxes to promote macroeconomic goals.

A bank lending b financial capital markets c government spending. In fact among all the tools their implementation is the easiest and fastest. Which of the following best describes a fiscal policy tool.

The basic difference between macroeconomics and microeconomics is. Regardless of whether you are looking through the microeconomics microscope or the macroeconomics telescope the fundamental subject material of the interconnected _____. Which of the following best describes fiscal policy.

Fiscal policy refers to government measures utilizing tax revenue and expenditure as a tool to attain economic objectives. The three tools of fiscal policy are government spending taxation and transfer payment to impact aggregate demand. Which of the following best describes a monetary policy tool.

O government spending O bank lending O financial capital markets household spending. Question 2 1 1point Which of the following best describes a fiscal policy tool. Reading 16 LOS 16p.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Monetary Policy Vs Fiscal Policy Economics Help

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

No comments for "Which of the Following Best Describes a Fiscal Policy Tool"

Post a Comment